It’s that time of year again. Semi-annually, I like to check in on the performance of North Redondo Beach new construction town homes.

As always, we will focus on MLS areas 151 (Villas North) and 152 (Villas South).

For this post, I will be covering both two-on-a-lot and three-on-a-lot happenings as there has been a lot of action. Additionally, I will try to keep the structure and comments the same as my blog post six months ago titled, “North Redondo Beach New Construction Update,” so you can see how things have changed.

Three-on-a-Lots

Six months ago, you may remember that developers started to go bigger and bolder with three-on-a-lot developments to drive their profits higher.

The North Redondo buyer of old could not afford nearly as much as today, so developers used to build 1,900 square foot units with low heights to keep building costs down. Today, some developers are going over 2,200+ square feet with maximum 30 foot heights to achieve large lofts and extra living area space.

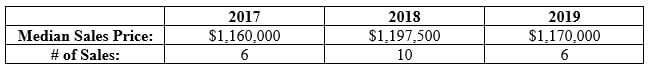

Looking back six months ago, that strategy was paying off as larger units were getting a median price of $1.17 million, while smaller units were getting $60,000 less. Presently, the larger units are getting the same price after completing three more sales in 2019, as you can see below.

Larger Units (2,150+ sq. ft.) Median Sales Prices:

Developers who stayed with the tried and true smaller units were rewarded with better profits over the past six months as the price gap between larger and smaller units closed.

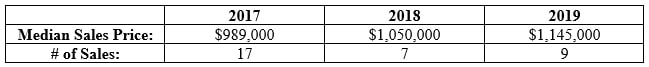

The smaller units, as seen below, jumped $35,000 to close the gap to just a $25,000 difference between large and small.

*There are two pending sales that will bring the sales number to eight in total and keep the median price the same.

Smaller Units (1,900 – 2,150 sq. ft.) Median Sales Prices:

Smart developers that stayed smaller decided to improve their finish look…a shrewd tactic that looks to be paying off.

Certainly, buyers will appreciate a 2,200 square foot unit a lot more than a 1,950 square foot unit, but if you were a developer wouldn’t you want to save $50,000 in building costs if you were to make only $25,000 less?

The back and forth between larger units and smaller units will be fun to watch in 2020.

Two-on-a-Lots

Two-on-a-lot sales have been on fire over the years. As you can see below, the record high new construction sales have risen well over 50% in just six years. If you put down just 20% in 2013, then your return on investment is significant.

- 2013 High Closing – $992,000

- 2014 High Closing – $1,019,000

- 2015 High Closing – $1,250,000

- 2016 High Closing – $1,328,000

- 2017 High Closing – $1,400,000

- Excluding the oversized lot sales at 3307 Green Lane and 1981 Dufour Avenue

- 2018 High Closing – $1,500,000

- 2019 High Closing – $1,550,000

- Excluding 1905 Belmont Lane #A & #B at 2,526 and 2,589 square feet respectively

- Excluding 1919 Gates Avenue at 2,800 square feet

My last blog stated that while there were no record breaking sales above $1.5 million in 2019 yet, inventory remained low. So, it was a toss-up on if we would see a new record high.

Well, the moral of the story is do not bet against the trend, especially North Redondo two-on-a-lots. The market saw not one, but two record breaking $1.55 million sales, along with three $1.5 million sales that matched last year’s record high.

Time and time again, buyers have shown that they are willing to pay big bucks for a new product with 2,500 square feet, four bedrooms, and a front and/or backyard.

Large Two-on-a-Lot Outliers

There are a few outliers that I would be remiss to leave out.

In 2017, 3307 Green Lane and 1918 Dufour Avenue were bold, oversized two-on-a-lots that did not justify building unless a developer could make a proper return for the construction costs. It was risky.

The standard two-on-a-lot new construction sales price was $1.4 million in 2017, however, Green Lane and Dufour Avenue were able to land sales of $1.48 million each.

Earlier this year, another developer decided to go big with oversized 3,000 square foot units on Harriman Lane.

2022 Harriman Lane #A & #B fetched $1.75 and $1.76 million, respectively, far above the record of $1.55 million for a standard sized unit.

Recently, another developer went big at 2,800 square feet. Surely, they would get the large $1.7 million premium, right? Unfortunately for them, the answer was no.

1919 Gates Avenue landed a disappointing $1.625 million, a full $125,000 less than the records on Harriman Lane.

What gives? It was definitely not the market, but in fact, a mistake by the developer. Rather than offering a coveted fifth bedroom like its 3,000 square foot counterparts, they only included four bedrooms like the many standard sized units.

Bedrooms are a big deal for buyers needing to house more people!

This was an unfortunate mistake that proved costly to someone’s bottom line.

Conclusion

All in all, here are the conclusions on the latest for North Redondo new construction town homes…

The larger unit three-on-a-lot new construction town homes have been disappointing in terms of price growth. There were three additional sales since the last blog and the median price stayed at $1.17 million. Even more disappointing, is that the median price for larger units were almost $1.2 million last year.

On the flip side, smaller three-on-a-lot new construction units jumped nicely since the last post. Stunningly, these smaller three-on-a-lots jumped almost $95,000 in price from last year!

As a whole, three-on-a-lots could be described as flat or slightly growing. The more affordable units are drying up quickly, which could be an indicator that things will continue to go higher.

With regards to two-on-a-lots, it is going to be another banner year. New record highs year after year!

Can they make another record next year? Will we see developers push for larger five bedroom units to test if they can achieve $1.8 million prices?

For now, it seems like the sky is the limit for two-on-a-lot prices and development. Only until large neighboring single-family homes, in places like Golden Hills, South Redondo, and areas of Hermosa Beach, offer more value will these town homes start to slow down.

I was a skeptic for years on if the market could keep up this meteoric growth, but it looks like the demand will continue to outweigh for two-on-a-lots and likely three-on-a-lots into 2020, and maybe, beyond.

Catch you back in six months for the latest.