New construction town homes in North Redondo are always an asset class I keep my eye on because they can tell you where this market is headed through strength of sales and price growth. Today, I will be doing my semi-annual check in with this section of the market known as MLS areas 151 (Villas North) and 152 (Villas South). Let’s see what’s going on…

Three-on-a-Lots

The three-on-a lot market has been tricky to judge over the past few years due to developers going bigger and bolder with their builds in search of more profit. Check out my previous blog post from last year on some of these lots.

Let’s start with the “bigger” three-on-a-lot performance…

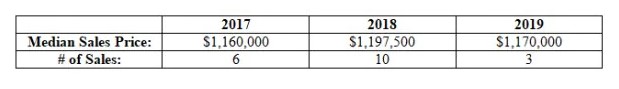

Larger Units (2,150+ sq. ft.) Median Sales Prices:

As you can see, 2019 median prices are off to a sluggish start in comparison to the steady growth seen in 2017 to 2018 (although a bit unfair with only three sales). Currently, there are two active listings asking around $1.25 million which would bring the median price above 2018’s median price. These two homes are pushing close to 2,300 sq. ft. with one even sporting a 5th bedroom!

What is interesting here is developers are building even bigger three-on-a-lots, between 2,200 and 2,300 sq. ft., that sometimes include an extra bedroom to reach that higher price point.

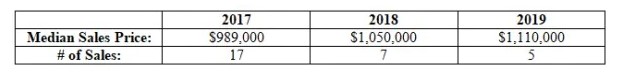

Smaller Units (1,900-2,150 sq. ft.) Median Sales Prices:

My October blog post separated this product type to just between 1,900 and 2,000 sq. ft.. But in the search for profit margin, developers have continued to push bigger. This time around I have taken anything between 1,900 and 2,150 sq. ft. because if we had stayed within the old metric, then prices would be down handily.

Again, builders have found that buyers want more space and are willing to pay for it. The growth is not just demand from buyers, but builders building much larger units to justify the continual price increases.

The only inventory available now is 2,000+ sq. ft.! The days of 1,900 sq. ft. three-on-a-lots might be a thing of the past due to part demand and part margin requirements for developers.

Two-on-a-Lots

If you read my North Redondo New Construction blog post last year, then you know that two-on-a-lots (typically 2,400 to 2,600 sq. ft.) had had a meteoric price rise higher over the last few years. However, there were signs showing that the area may have reached its peak last April with a $1.5 million sale, a record for the area.

Let’s examine price growth of two-on-a-lots, 2018’s performance, and where we are now…

- 2013 High Closing – $992,000

- 2014 High Closing – $1,019,000

- 2015 High Closing – $1,250,000

- 2016 High Closing – $1,328,000

- 2017 High Closing – $1,400,000

- Excluding the over-sized lot sales at 3307 Green Lane and 1918 Dufour Avenue

- 2018 High Closing – $1,500,000

- 1729 Harriman Lane #A

- 2019 High Closing – $1,460,000

- >2410 Huntington Lane #A

- Sold in April 2019

- >2410 Huntington Lane #A

Much to my surprise in 2018, another new construction town home reached the $1.5 million mark at 2206 Warfield Avenue #A, a property I had mentioned in my October 2018 blog post. I discounted this sale because it happened off-market and felt like a very high sale for the location.

It seems that builders took note of the shrewd off-market sale on Warfield. Per the MLS, nine of the 26 new construction sales happened before coming to market. The game plan is simple: Find an over-eager buyer willing to pay your price and ditch the risk of going to the MLS where Buyers are refusing to pay $1.5 million and who quite frankly, want to pay even less.

For the end of the 2018 year, two-on-a-lots median sold price was $1,440,000.

Six of those nine pre-MLS sales closed at $1,475,000 or higher in 2018, helping to pump the market comps higher.

Compare that with the 2017 median sold price of $1,330,000.

Here are the 2019 new construction two-on-a-lot sales, thus far…

- 2119 Marshallfield Lane #B – $1,450,000

- 1909 Huntington Lane #B – $1,435,000

- 2410 Huntington Lane #B – $1,450,000

- 2410 Huntington Lane #A – $1,460,000

- 1819 Morgan Lane #A – $1,380,000

- 1819 Morgan Lane #B – $1,420,000

That is a median sales price of about $1,442,500 which in turn shows a flat market to start 2019, if not a sign of some price fatigue.

That said, there are pending properties that could push the median price to over $1,450,000…including two BIG pending sales asking $1,500,000 that would match the record price of 2018. Additionally, there is only ONE new construction property available illustrating that inventory is still tight.

With all of this data, it is tough to tell if the new construction two-on-a-lot market is losing steam or gearing up for another pop in growth.

Outliers – Helping the Market Go Higher?

Below are two MASSIVE 3,000 sq. ft. town home outliers that market watchers need to keep an eye on:

- 2022 Harriman Lane #B – $1,750,000

- Sold in April 2019

- 2022 Harriman Lane #A – $1,760,000

- Sold in February 2019

A developer made the bold decision to go about 500 sq. ft. bigger than your typical build to get a 5th bedroom and an extra bathroom. Normally, this is a risky bet trying to capture a quarter of a million premium in price than the highest record sale. However, this developer pulled it off and was able to sell these big units for a big number. No risk, no reward!

An extra 500 sq. ft. would cost about $100,000 more per unit to a developer, but, when it yields an additional $250,000 in total for each unit then that becomes a no-brainer.

Will this push prices higher? Or, is this a classic huge number that represents a medium or long term top? Or, will developers try to go even bigger and better to expand profit margins in an ever more competitive market?

These sales most certainly throw a wrench in figuring out the direction of this market…for buyers, sellers, and developers.

Conclusion

Prices have been driving higher over the past few years, with small signs last year of a plateau on the horizon.

Prices continue to rise because the town homes being offered are significantly bigger than in years past. Today, developers are increasing the size of standard square footage of these town homes and they are getting rewarded with higher sale prices!

The growth is encouraging but I would like to see more healthy price increases without developers having to go bigger and bolder to get larger numbers.

Is the market going higher due to crafty building and marketing, or is there a true demand for larger spaces in North Redondo? If it is the former, then that, to me, is unsustainable long term because you can only build so big. But if it is the ladder, then growth is likely healthy/sustainable to lead the new construction market even higher over the long term.

I will report back in about six months to deliver the latest North Redondo new construction updates! Hopefully, there will be more clarity in the numbers to give us an idea of where the market is going.