With the amazing price growth in Southern California real estate, I have clients lined up who are ready to buy their first income property and clients who want to continue adding to their portfolio.

I know a lot of great agents that would scour the market for the best deal and be glad to sell someone an income property right away.

For me and my clients, I suggest that they wait.

In my opinion, there will be a better time to buy an income property down the road.

As a full-time real estate broker and investor myself, I want to share my reasoning with everyone in this latest post.

The Market Feels Stretched

As many of my clients know, I think income property values feel stretched. I won’t even begin to discuss the insane prices of income property by the beach, but today, I will chat about how less desirable locations are offering very low returns. Too low for my taste.

I have been slow to produce my long overdue special report that was promised earlier in the year. That report is coming and I will share more data on why the market is stretched then.

For now, please reference my two blogs, Is California Real Estate on Borrowed Time? Bruce Norris Answers and South Bay Real Estate: 2018 Data for Homeowners on potentially stretched California and South Bay property values.

Finding income properties specifically that will give you a return above 5% on an all-cash basis is extremely difficult to locate in our local markets.

If you borrow on an income property to amplify your appreciation (if you get appreciation), then your cash flow returns are made even lower.

These lower and lower returns have been the fuel to Southern California price appreciation and I am just not sure how much lower investors can go to continue this price growth.

Cash Flow Drives Decision Making

During the Great Recession, I went to a real estate event that featured a panel of experts and full-time institutional real estate investors.

There was a specific company that operated apartment buildings who had no idea that the downturn was coming, but sold all of their assets except for two of their favorite buildings right before the crash.

Here was their simple reasoning and a quote that stuck with me forever…

“In 2005, we noticed that finding a deal that met our investment cash flow criteria was almost impossible. So, since it was extremely difficult to be a buyer during that time in the market, we thought it would be wise instead, to become sellers.”

Boom! Very simple.

Personally, I look for cash flow that makes a reasonable return on my money along with the inherent work required in owning a specific property. In this market, it is tough for buyers to meet a reasonable return as compensation for the work involved.

Would I buy income property in this current market? Absolutely not.

The better question: “Would I buy the current income properties that I own at the price they are worth today?” My answer to that is “no” as well.

The Numbers on My Property

So, with that all said, I am a Seller of my triplex in Hawthorne.

- 12828 Doty Avenue, Hawthorne

- 8 bed, 6 bath, 3,709 sq. ft., 5,399 sq. ft. lot

- Asking: $1,100,000

Let’s dive into the current numbers.

Assumptions

- Purchase price: $1,100,000

- Loan: $550,000 at 4.5% fixed over 30 years

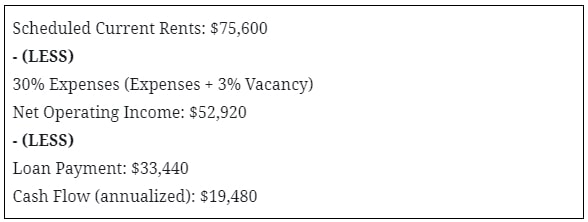

Cash Flow Numbers

On a $550,000 down payment, that is about a 3.5% ROI.

Those expense numbers are tight. They also do not include a budget for capital improvements, miscellaneous expenses, or professional property management.

So, you could realistically be earning 3% on your half a million dollars and take on all the headaches of managing a property…and my asking price is a darn good deal in today’s market. No thanks!

I purchased my property a little over five years ago because I could cash flow it after six months with 100% financing. Out of sheer luck and good timing, my property value has doubled during my ownership.

But, is that appreciation sustainable?

It most definitely can sustain as long as rent continues to grow and drive the cash flow higher.

So can rent continue to surge higher?

According to Census.gov, the median annual income of Hawthorne residents (in 2017 dollars) is $47,636.

For example, the recently rehabbed 3-bedroom unit in my Doty triplex listing will fetch $2,600/mo. or $31,200 annually.

I will assume a dual-income couple working full-time will bring in 1.5 times the median income.

At 1.5 times the median income, that is $71,454 a year. If rent is $31,200 annually…then 43% of their income is going to rent BEFORE taxes.

Where the heck are you going to get the rent growth to drive you future value?

In my mind, without growing rents, you cannot drive higher cash flow, and thus, it is going to be very difficult to drive the outsized appreciation we have seen over the last five to eight years.

Personally, I am unwilling to earn 3% on my money with very low prospects of appreciation in the short to medium-term.

The only path to growth is interest rates going even lower beyond historically low interest rates.

At some point, I think other buyers will share my feelings. The feeling that low returns and the tough work of self-managing property is simply not worth doing at these ultra-low returns.

Other Competing Investment Options

So why would I be coming to this conclusion?

It is simply that my capital wants to earn its most efficient return.

I am a real estate guy, so I understand and like hard money loans. Why not lend to flippers in markets that I know at a 9% interest rate with a 1% origination fee? It is the same amount of work as owning a property, and I earn a 9% rate. That clearly wins.

What about buying stocks?

Everyone needs banks in this country. JP Morgan Chase is widely considered one of the biggest and most well-run banks in the United States. They pay a dividend of over 3%. That will likely match the cash flow return of my triplex in Hawthorne. And, owning a stock requires ZERO work.

There are countless stocks that offer low dividend with growth prospects like Apple, or slow growth companies with big dividends like Exxon Mobil or AT&T that offer almost 5% and 6% dividends, respectively.

Some of my clients are going out of state and are finding real estate cash flow returns at 10% or more. That sounds a lot better to me than income property returns in Southern California.

Some investors are stock people forever and always. Some are real estate people. Some are hard money people, etc. You get it…

My point is that to earn 3% on real estate you basically have to run a small business. At that low rate of compensation, I don’t think the juice is worth the squeeze.

So as a result, I’m a Seller.

Conclusion

Owning real estate is a lot of work.

In the income property business, there are legal risks, fire/earthquake risks, and management headaches…just to name a few.

As a real estate broker and active investor, I am just not willing to earn a 3% yield with limited upside in the short to medium-term. I will wait for a time when returns are higher and when real estate falls out of favor (if it ever happens).

If you are long term and want to hold a property for decades, then, by all means, buy real estate and wait.

If you are a 1031 exchange investor with a huge capital gains liability, then again, keep rolling your money long term into real estate.

But, if you are a first-time buyer investing a significant amount of your capital and need to get the purchase 100% right, then I think it is prudent to wait.

If you have been trading in and out of property over the last few years, I think that is getting riskier. Slow down and be patient.

As for me, I am trying to remember the wise words I heard years ago…

Since I cannot get anything to pencil for me today as a buyer, then I should probably consider being a seller.

For more information on why I am selling, be sure to read “Why I am Selling My South Bay Residential Income Property Part Two” to get an even deeper analysis on my reasons for selling.

Bonus: The Property

For those of you that disagree with me or are always very long term investors in real estate, take a look at my property that I am selling on the open market.

- 12828 Doty Avenue, Hawthorne

- 8 bed, 6 bath, 3,709 sq. ft., 5,399 sq. ft. lot

- Asking: $1,100,000

It is priced very competitively relative to the comps and offers a great CAP rate compared to the local market. If you would like a set-up sheet, feel free to email me at richard(at)manhattanpacific(dotted)com and I would be happy to provide you with more information.