About every two to three years, the home market’s most trending topic is interest rates.

This has happened every couple of years in recent memory because home mortgage rates have moved up or down significantly, which in turn affects buyer’s payments in a meaningful way.

If you know me, I predictably get annoyed hearing radio advertisements from lenders, local Realtors making commentary, and anyone else who has not done their homework. It goes like this:

Rising Rate Environment: “Interest rates are rising; hurry up and buy before they go even higher!”

Falling Rate Environment: “Rates are falling to lows; hurry up and buy before they go up!”

It frustrates the heck out of me because interest rates, whether high or low, should only be a small factor when considering a home purchase (or sale).

But I digress – Let’s get to the facts that can help guide you in this rising interest rate environment.

No Correlation to Rates and California Home Prices

The statistics show that there is absolutely ZERO correlation to home mortgage rates and California home prices.

That’s right – there is no correlation.

So, while the hottest topic around is that rising rates will cool the housing market, that is a notion that certainly deserves discussion but there is no data to support the thesis.

In fact, the data clearly says it is like flipping a coin if you are trying to predict home prices purely on home interest rates. I am going to copy/paste pre-Great Recession data regarding interest rates and California home price appreciation (or depreciation).

Below is historical California interest rate and median price information.

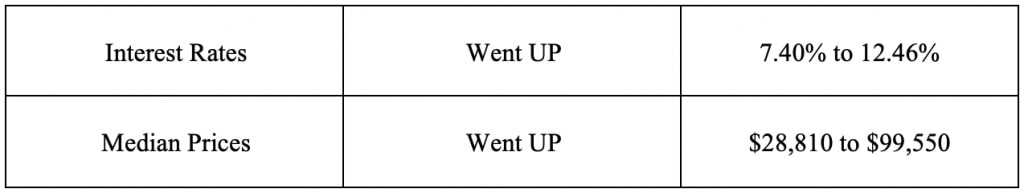

1972-1980

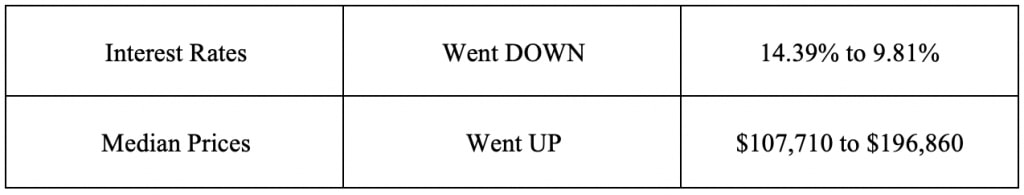

1981-1989

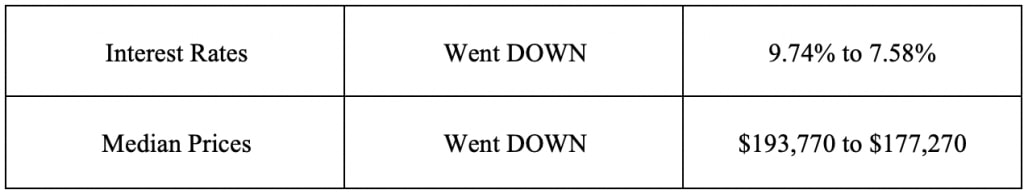

1990-1996

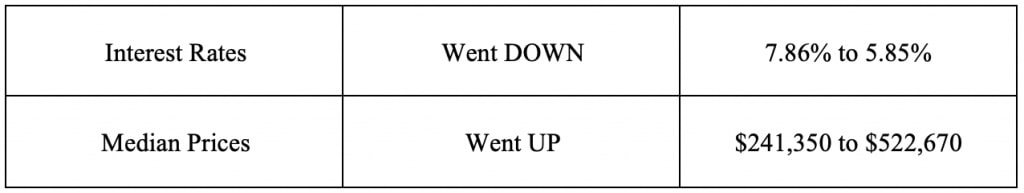

2000-2005

Is that not incredible?

In four different time periods, we saw rates up and prices up, rates down and prices down, rates up and prices down, and rates down and prices up.

That is the definition of zero correlation.

If you want to read my March 2019 blog post full of additional California home price and interest rate data, please see: “California Interest Rates are Rising – Should You Buy Now?”

If you would like additional context on the subject matter, I would give it a read.

All in all, I want readers to understand that interest rates are a small factor in the grand scheme of our local real estate markets.

What are Other Factors to Focus On?

If one’s only focus is on interest rates, then you are going to miss the mark on how to analyze the housing market to fit your goals.

The main items you should be focused on are:

- Median Income and Affordability

- Inventory and Sales Numbers

- Median Price Movements

The above is the most readily available data to understand the market in real-time. And, if you follow my blog weekly, you will get all that information along with my take on the numbers.

If you want to reference that information now, please look at my latest quarterly report and my past blog post on the Housing Affordability index.

- Latest Quarterly Report: “Scorching Hot Q1 South Bay Home Numbers”

- Housing Affordability Index Post: “Update: Q4 California Housing Affordability Rises Again”

These two posts will give you the data for the main items you should focus on for real-time numbers.

Other additional factors to consider, among others, are below:

- Demographics

- Migration

- Foreclosures

- Construction

- Lending Standards

- Geo-Political Happenings

- Other local and/or relevant factors determined by your real estate agent to influence the market you are considering

And yes, I posted this same list back in August of 2019: “How Are Interest Rates Affecting the Housing Market?”

I believe the list is just as applicable today with some items holding more weight based on the current market, along with economic and world news.

For me, in today’s market, the most headline worthy items are Inventory, Median Price, Demographics, Affordability, and Interest Rates – and in that order.

Using Specific Factors to Analyze the Market

Let me break down my opinion on the above factors highlighted.

Please remember, this is an opinion based on light research by a full-time Realtor, not a professional economist or big data housing expert.

Inventory

This is the most important topic of the moment in our local South Bay home market. Quite simply, there are too few homes for sale compared to the outsized demand for those homes.

It is creating a classic supply/demand squeeze.

If you study last week’s blog post, you’ll see the precipitous drop in active homes for sale compared to last year. I noted that homes for sale in many areas are at historic, all-time lows.

Median Price

As a result of a historic supply squeeze with incredibly high demand, the median home price in the South Bay has surged.

Prices were up in a massive way in 2021 and according to the first quarter numbers of this year, the home market is continuing its strength locally with some areas accelerating (see Palos Verdes Estates meteoric 68% year-over-year growth).

Demographics

This is something I quantify less on the blog, but a topic I want to address more in the future.

For those interested in demographics and how it might affect the South Bay, State, and National home markets, I highly recommend John Burns’ book, “Big Shifts Ahead: Demographic Clarity for Business.”

Much of this book will explain my commentary about Millennial family formation driving the demand in this market, along with the dual income earning aspect of this generation.

But even more so, I want to highlight the statistics above in the 1972 – 1980 timeframe and the 1981 – 1989 timeframe.

From 1972 -1980, home mortgage rates surged from 7.5% to 12.5% due to inflationary pressures across the country. But guess what happened? Home prices surged by more than 200% in eight years.

From 1981 – 1989, home mortgage rates finally saw some relief and fell from 14% to 9.8%. And what was the result? Median prices went up almost 90% in that eight-year time period.

Now where am I going with all of this?

The old saying sometimes credited to Mark Twain, “History does not repeat itself, but it often rhymes,” is applicable here.

Baby Boomers formed families and hit their stride economically during the two above time periods. It did not matter if interest rates were rising or falling, the sheer size of the largest generation ever pushed home prices higher.

This time around, the children of the Baby Boomers, Millennials, are an even larger demographic base and they are forming families while hitting their economic stride. Not to mention, Baby Boomers are living longer and not selling their homes to satisfy the demand coming from their children.

In the South Bay, there is simply no land to build additional housing like you can in a place like Arizona or the Inland Empire.

To me, this is the biggest real estate story of the moment and likely well into the future.

Affordability

Many weekly readers know that I believe the California Association of Realtors “Housing Affordability Index” is the most important indicator when it comes to predicting where home prices might go in our great state.

For now, the Housing Affordability Index number is stable and relatively reasonable.

That said, if those numbers change to less and less affordability, then this is a number to watch very closely to see if the market may be shifting in the near-term.

Interest Rates

And finally, I arrive to interest rates.

While I have spent much of this post discounting the value of interest rates’ effect on the market (data showing rates having zero correlation to California home prices), they still hold weight. Rates just need to be accounted for in addition to the other main factors written about above.

Without question, rising interest rates will eliminate home buyers, but how significant is the demand destruction? It is still too early to know how rising rates will affect the market, as the rise is a recent development that is hard to measure at this juncture.

Conclusion

There are a few points to make clear in this post.

- There looks to be ZERO correlation between home interest rates and California home prices.

- You must consider many additional factors, beyond rates, to come up with your real estate thesis.

- In my opinion, Inventory and Demographics are the two most significant factors affecting our local South Bay home market today.

While it is impossible to know where interest rates go from here, along with their affect on our local and California housing market, I do believe you can measure a multitude of factors to make the right decision for yourself personally.

The only advice I can offer you is to buy when you are ready and can afford it, and of course, only sell when you are ready, and it makes sense for your goals.

Ultimately, the only truism based on the past is that investing in a home over the very long haul will turn out positive – but this is a an extremely long-term approach that consists of a decade, and if you bought at the height of the Great Recession, then an even longer hold period.

This market is so much more than interest rates, and whatever you think rising rates will do to the market, there is a better chance that the opposite is true.

Buy or sell when you are ready and make smart, data-driven decisions that you are willing to commit to for a decade or longer.

Have a great weekend!