The old Realtor adage “Interest rates are rising – go out and buy now!” is oftentimes a misguided statement for most buyers. For this week’s blog post, I want to address this proclamation and why more often than not, it is not accurate. Everyone’s financial goals are different and interest rates should never be the one driver behind buying a home.

Interest Rate Realtor Claims

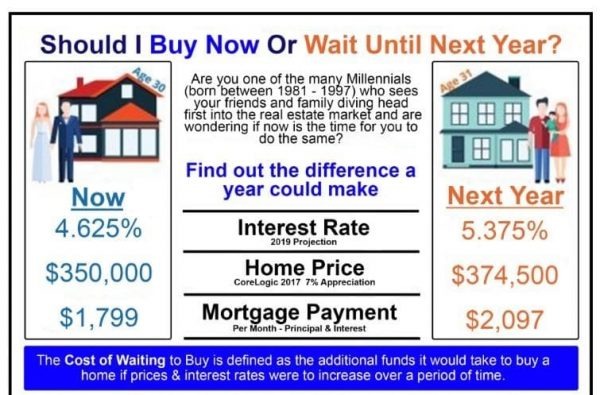

Take a look at this chart below that has been flying around social media:

Source: The Romanski Group

I have seen variations of this chart posted over the years. Whoever created this graphic was very smart to target specific buyers in order to sell more real estate. That said, buyers need to be smart and understand if this chart actually applies to you. There are many factors you must consider in addition to interest rates.

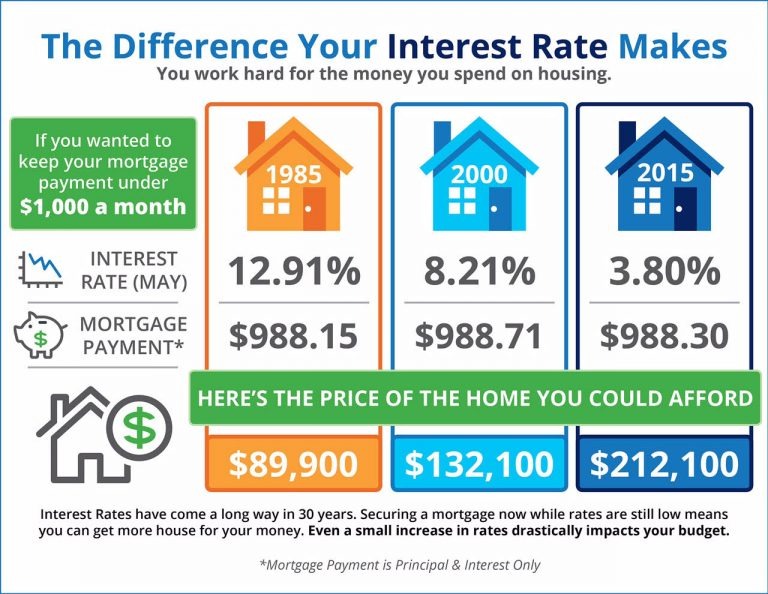

Take a look at another chart:

Source: Jagoe Homes

I hate this chart because it is showing buyers how much they can afford to make a quick sale in a low interest rate environment. I would hope the consumer is smart enough to say, “Well, what if rates go back to 12.91%, or even 8.21%? Does the value of my house get cut in half so new buyers can afford it?”

Interest rates should not be the sole driver of your decision making. Also, Realtors should NEVER be touting rising or falling interest rates as a sole advertisement on whether it is a good time to buy or sell.

California History and Data

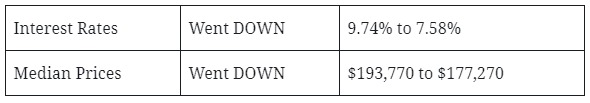

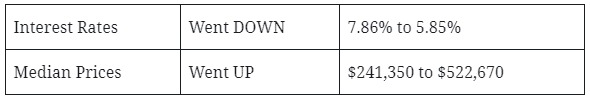

Let’s look at some historical California interest rate and median price data.

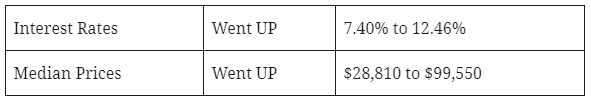

1972-1980

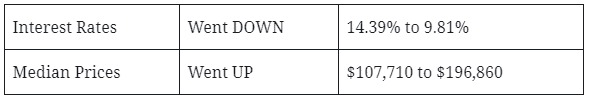

1981-1989

1990-1996

2000-2005

Do you see any correlation with prices and interest rates in California? No! There is nothing that shows there is a strong correlation to interest rates and price over the past few decades.

Interest rates of course play a factor, but the real estate market is much more complex.

Additional California Data

The charts above inspired me to look at data involving rates, prices, and corresponding incomes in the state of California during that specific time period. Perhaps then, I could identify more data points that could show a trend.

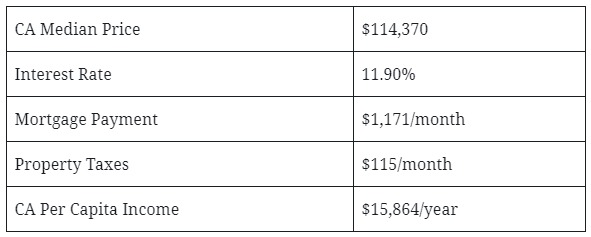

1984

The yearly house payment to income ratio was almost 94 percent.

The cost to buy a home all-cash was about 7.21 times annual income.

During this time, the nation was coming off crazy inflation, Baby Boomers forming households faster than ever, and Regan tax cuts and military spending were helping to fuel the economy.

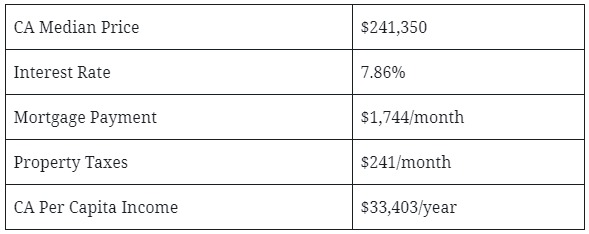

2000

The yearly house payment to income ratio was almost 71 percent.

The cost to buy a home all-cash was about 7.23 times annual income.

During this time, California was coming off a lagging real estate market for almost a decade, the tech bubble burst, and Millennials were not yet making an impact on the housing market like Baby Boomers did since the oldest Millennials were just starting to graduate from high school.

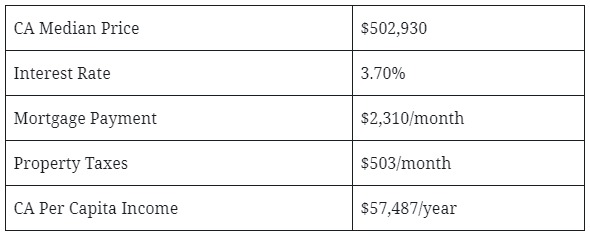

2016

The yearly house payment to income ratio was almost 58.72 percent.

The cost to buy a home all-cash was about 8.75 times annual income.

During this time, the economy is coming off of QE ending, a heated presidential election, and Millennials slowly becoming the biggest buyer cohort, set to be even bigger than Baby Boomers.

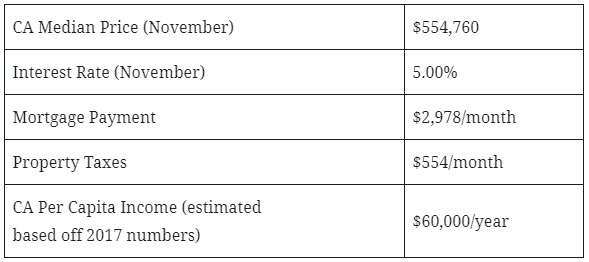

Late 2018 Numbers

The yearly house payment to income ratio was almost 71 percent.

The cost to buy a home all-cash was about 9.25 times annual income.

In October, prices were at $572,000 and fell to $554,760 in November. Rates were rising and the stock market was correcting. The story can go on and on; however, you know what is going on since you are living through this time in history right now!

Conclusion

Interest rates, whether rising or falling, do not dictate if it is a good time to buy. You need to look at the data and your personal situation to make the best decision for you. There is a hodgepodge of factors within the economy, demographics, income levels, local factors, rent control, rental rates, etc. that should guide your decision-making.

The right timing is also very important. Are you a very long term buyer? Short-term buyer? Or, somewhere in between? Always remember, your situation can change in an instant and completely throw off your plans.

Do your research and talk to your trusted advisers. And don’t let interest rates be your only source of decision-making!